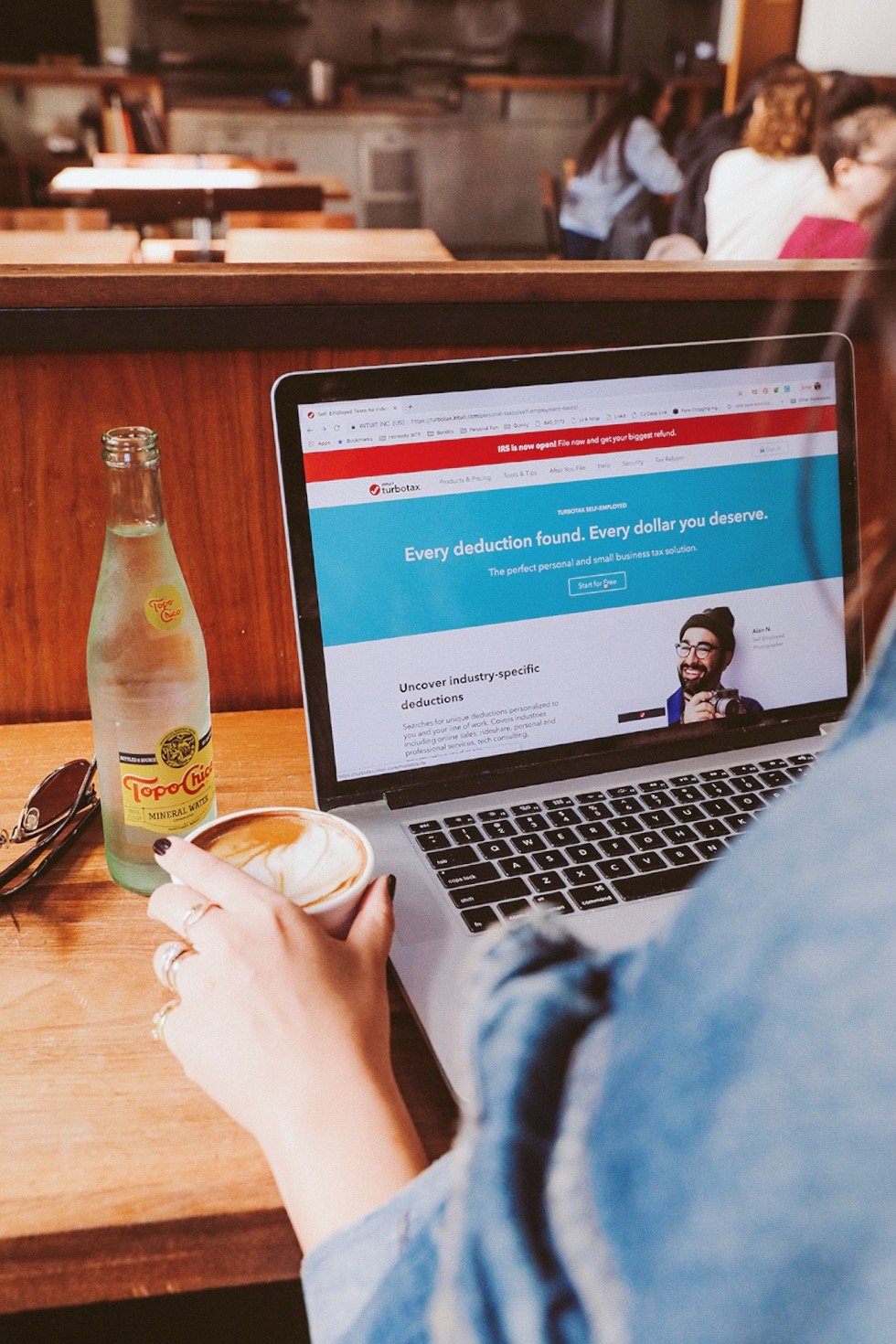

Here we are again. Tax season. Eek! It's usually the most anxious time of year, isn't it? Especially for us procrastinators. Truth be told, my husband usually handles our taxes but this year, I really wanted to prove to myself that I can do it on my own. TurboTax recently offered me to test out their product for self-employed filers so I figured now would be a better time than any to finally get good grasp of my own finances, especially since I've owned my own business for nearly 10 years now. So, thank you hubs, but I've got this! And to be totally honest, it ended up not being as daunting and confusing as I dreaded it to be. If you are a sole proprietor of a business, work as an independent contractor, a consultant, a freelancer, or have a side gig doing your own thing, I encourage you to try out TurboTax Self-Employed and challenge yourself to file your own taxes this year.

4 EASY STEPS TO FILE YOUR OWN TAXES

- Gather your earning statements: By now, you should have received several 1099s in the mail. These come from all of the clients, brands or businesses that have paid you the previous year. If you haven't received any, you should reach out and remind them to send them your way. And remember, even if you are missing a 1099 here or there, for whatever reason, you must report all income.

- Organize your receipts and invoices, with help: Tracking expenses for deductions can normally be the most time-consuming part of tax filing. Being self-employed, you can claim certain exemptions and deductions on your tax return. The key to making this more manageable is to habitually reconcile expenses throughout the year so you're not sorting through hundreds, if not thousands, of receipts during tax season. Thankfully, TurboTax Self-Employed makes it super practical and easy by including a complimentary one-year subscription to QuickBooks Self-Employed, which allows you to track and reconcile your expenses in real time, track your car mileage for each trip (which can end up being a significant deduction for a lot of us that are self-employed!), and capture and save receipts using your app so you're not holding onto a year's worth of paper receipts.

- Get every deduction you qualify for: Tracking and managing your deductible self-employment expenses can help you save money at tax time. TurboTax Self-Employed will help you get every deduction you qualify for, including industry specific tax deductions - which, trust me, makes a difference! You may be eligible to deduct expenses for: business related supplies like paper, pens, computer/laptop, cell phone, business travel, health insurance premiums, costs of maintaining a home office, office rent or co-working space fee and more!

- Complete and submit: After you've double checked that all your 1099s have added up to the amount reported on your return, you're ready to complete and submit your return! Since you're self-employed, you may need to pay quarterly estimated taxes throughout the year. If you need extra help or advice along the way, you can use Turbo Tax Live Self-Employed to connect with a real CPA, on demand, for unlimited help and advice all year.

A Few More Tips . . .

- Consistency: Manage those expenses and invoices consistently throughout the year. Make it a habit of saving your receipts, reconciling those expenses and issuing invoices no matter the circumstance. In the end, it'll make your life (and tax filing) so much easier!

- Ask for help: Don't be afraid to ask for help. As streamlined as the process is, I definitely tapped into TurboTax Live Self-Employed to click to connect with real CPAs. I reached out to them on several occasions for questions, roadblocks, and to simply review my return to make sure I dotted all my i's and crossed all my t's.

- Take advantage of all the features: Between the expert help and personalized audit assessments from TurboTax Live Self-Employed and the year-round expense tracking from QuickBooks Self-Employed, all the resources you need to make this process as painless as possible are there for you! Take advantage of the support that's offered.

- Community: Talk to people who are in the same or similar industry for advice. We should all be helping each other out and exchanging tips. If any of you ever need any advice, don't hesitate to comment below or email me directly.

- Good luck and happy tax season!

This post was created in partnership with TurboTax. All opinions are my own.

I despise tax season. Thank you for breaking it down here. I just started doing freelance photography and don’t even know where to begin with my taxes. Thanks.

I am an aspiring business owner. Perhaps I am a bit over zealous but I read this article with great interest as I look forward to the day that I am free to work for myself. I want to compute and pay my taxes. Crazy I know but I embrace ALL that business ownership entails.

Hey, very good information about the tax shared by you in this post. So I also want to share some free €5 no deposit casino to earn real money. You can check the gamblingorb website for casino-related offers and discounts.

Thanks for the post

Best regards

casino movie facts

Good afternoon. I also work for myself and improve the computer software for Windows and MacOS. I really like to read your blog, and also, if you are interested in computer topics, I would like to advise this site https://softwaretested.com/windows/ , where I get a huge amount of information in all new software, and not only.

Since the IRS eliminated the requirement for paper returns, TurboTax is one of the most popular tax preparation software in the United States. The company was founded by a former accountant and CPA, Chuck Blahous

TurboTax has different versions for individual filers, small businesses, and those with rental properties. The prices range from $0 to $169 depending on which version you choose.

The individual version of TurboTax is free to download and use for simple tax returns. It includes personal income taxes such as 1040EZ or 1040A. If you have more complex tax needs, then it will cost you $59.99 to upgrade to Deluxe or Premier versions of TurboTax that offer more features such as business deductions or rental property information.

Guys, a couple of weeks ago I invested my savings in cryptocurrency for the first time. My friends highly recommended the site https://cex.io/buy-bitcoin-with-prepaid-card and I finally decided on it. You won’t believe it, oh I already made its first profit.